Pay types represent the individual components that are paid. These are the codes that directly align with what you pay in payroll and depending on your payroll system may also be referred to as Pay Components, Pay Categories, Pay Codes, Additions Codes, Income Types or Allowance Codes and also include Leave Reasons and Leave Codes. Though not essential for all payroll systems, ideally these are named in Humanforce with a description similar or identical to your payroll system so like-for-like comparisons can be made between the two systems for auditing purposes.

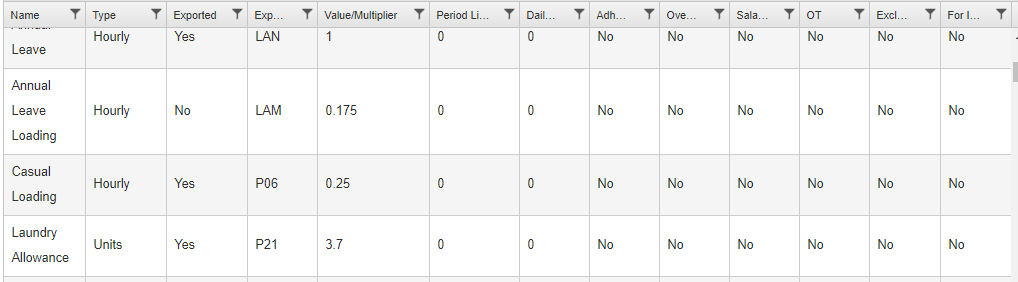

Pay types can be configured as ‘Hourly Types’ or ‘Unit Types’. Hourly Types multiply from the pay rate of the employee. These are pay types like Normal time (1.0x), Casual Loading (0.25x) or Overtime 1.5x (1.5x). Unit Types pay a fixed rate such as Uniform allowance or Tool allowance. Unit Types can also be created for "Ad-hoc Allowances", generally these are used when nothing can be automatically triggered in the award i.e. setting up KM Allowance as an Ad-hoc Allowance will allow you to manually enter the number of kilometers to pay at the correct rate.

If providing your Pay Types as part of an implementation, you should only provide the codes that are associated with the direct wages (i.e. do not include superannuation codes) but you should ensure all pay codes, allowance codes and leave codes you use, however infrequently, are provided so they can be discussed.