This article is about Humanforce Payroll. For help with Humanforce Workforce Management, start here.

Pay Adjustment Upload creates multiple Pay Adjustments at once by processing a CSV file you upload.

Completing a Pay Adjustment Upload is a two-step process:

Payroll must be in Active or Calculated status to do a Pay Adjustment Upload.

Pay Adjustment Upload is a separate menu item and may need to be added to your

Menu Construction and assigned to the relevant Role Definition. When you are in a

Special Run, this menu will replace the option to upload Pay Adjustments via Timesheet

Upload.

Step one: Prepare your upload file/s

There is a specific CSV file format for the Pay Adjustment Upload that is broken into three sections:

- Mandatory fields

- Header fields

- Item/Pay Element fields.

There can only be one header row per employee per upload file. If you want to upload multiple adjustments for the same employee, this would need to be done in separate upload files.

Using Employee 863 as an example in the pictures below, there is one row where the Record Type is Header and for that row, only the Header fields (in green) have been completed. Then for the rows where the Record Type is Item there is only data completed in the Pay Elements fields (in orange). As you can see the Header fields are blank in the orange section and the Item fields are blank in the green section.

See below for details on how to complete each field.

Mandatory fields

| Field name | Valid values | Notes |

| Record Type | Header, Item |

Header is for the details that are at the top of the Pay Adjustment (when you enter it in manually). See below. Item is for each Pay Adjustment you will be uploading. |

| Payroll Name | Values as found in the Payroll Names fields set up in your account. See the values listed in the drop-down on Payroll Enquiry Any Pay. | You can only upload to one Payroll at a time – separate Pay Adjustment Uploads would be required for separate payrolls. |

| Employee Number | Alphanumeric values as found in the Employee Number fields set up in your account. | Find individual Employee Numbers in Employee Enquiry Any Pay and start typing name in Employee field. |

| Transaction Type | Adjustment, Reversal | If the Transaction Type is Reversal only the Header row is required, no Item rows are to be completed. |

Mandatory fields example

Header fields

Only complete the following fields for rows where the Record Type is Header. The information needed is the same as the information you would enter if you were creating a single Pay Adjustment manually.

There can only be one header row per employee. If you want to upload multiple adjustments for the same employee, you need to do separate uploads.

| Field name | Valid values | Notes |

| Reference Pay Process | As per values in your account. | Only required when referencing a past pay process |

| Reference Payslip | As per values in your account. | Only required when referencing a past pay process |

| Average Gross | Numeric | Only required if you want to override the system average |

| Number of Periods | Numeric | Will default to 1, only enter if you want to override |

| Load Standard Allowance/Deduction | True, False | If left blank will default to False |

| Print Payslip | True, False | If left blank will default to True |

| Exclude from DMS | True, False | If left blank will default to False |

| Comments | Free text field. | Add comments to be displayed on the Payslip |

| Include in EFT | True, False | If left blank will default to False |

| Payment Type | Balance of Net, All Bank Splits | See Employee Masterfile for bank account distribution details. Payment Type options are only Balance of Net or All Bank Splits in the Upload – if you want it to be A Selected Pay Split, upload as Balance of Net first and then you will need to manually go into the Pay Adjustment and change to A Selected Pay Split. |

| Is Paid in Advance | True, False | If left blank will default to False |

| Is AdHoc EFT | True, False | Only applicable if Include in EFT is True |

|

EFT Release Date |

DD/MM/YYYY | Only to be entered when Is Adhoc EFT is marked as True |

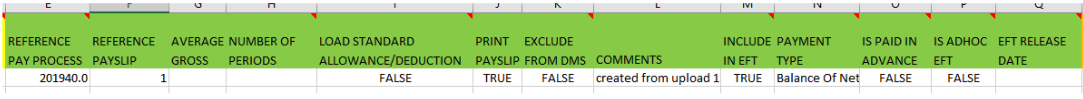

Header fields example

Pay Element fields

Pay Element fields

These fields relate to the actual Pay Elements you are wanting to upload. Only complete these fields when the record type is Item.

| Field Name | Valid values | Notes |

| Pay Element | As per values in your account. | See Customer Pay Element List for the Pay Elements set up in your account. |

| Hours/Qty | Numeric | |

| Date From | DD/MM/YYYY | Applicable for leave Pay Elements |

| Date To | DD/MM/YYYY | Applicable for leave Pay Elements |

| Amount | Numeric | |

| Percentage | Numeric | |

| Cost Centre | As per values in your account. | Only applicable where multi costing is used. See Customer Cost Centre for the cost centre values set up in your account. |

| Rate Amount | Numeric | Only applicable where a Rate Override is to be used |

Pay element fields example

Step 2: Upload your file/s

Once your file is ready:

- Go to Pay Adjustment Upload

- Select the Payroll

- Choose the file you want to upload. Then

- Click Process.

The software will check and automatically upload any Pay Adjustments that pass the Validation checks. All employees that have no errors will load directly in the Pay Adjustment and show as Complete.

Once you upload a Pay Adjustment, there is no ‘Override/Append’ option like with Timesheets, Pay Adjustment Upload always creates a new Pay Adjustment

If there are any errors, only those employees with errors will display on the screen. There are 2 types of errors, where the whole file is being rejected vs when only some employees with errors are rejected. Errors that result in the whole file being rejected will not show any value in the Identity column of the error message.

Resolve Employee Errors

To resolve the employee errors:

- Open your upload file and delete the employees whose Pay Adjustments were successfully created. If you do not remove the successfully loaded employees, the Pay Adjustments will duplicate, and you will have to manually delete the additional Pay Adjustments.

- Based on the error messages provided, amend the remaining rows.

- Upload the file containing the amended data for the employees that had an error.

Remember: Only re-upload the rows for employees that had an error.

Complete any manual entries required

PAYG Override cannot be done via the Upload – if you want to override the tax you will need to upload first and then manually go into the Pay Adjustment and override the tax

Lump Sum E is also not available via the Upload – these would need to be manually entered in.

If Is AdHoc EFT is true – the Pay Adjustment will be loaded into Complete status and you will need to manually Finalise